Low temperatures and decreased renewable energy production keep European electricity market prices above €100/MWh.

In the second week of March, weekly prices in most major European electricity markets exceeded €100/MWh and were higher than in the previous week. Higher electricity demand, associated with colder temperatures, and lower wind and photovoltaic energy production compared to the previous week in most markets favored this behavior. In addition, CO2 prices rose and gas prices exceeded €40/MWh again, after falling below that level at the end of the previous week. Brent futures reached their lowest level since September 11. Portugal registered the highest photovoltaic energy production for a day in March.

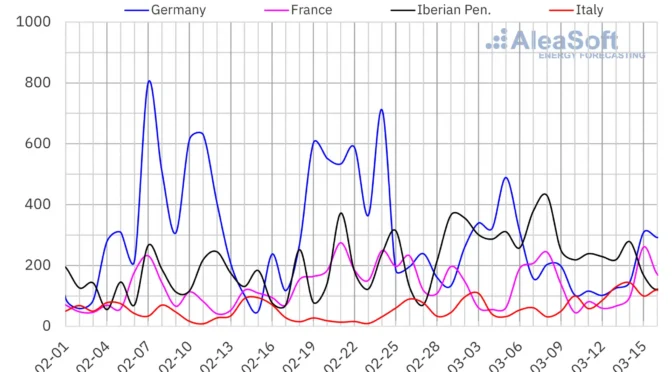

Solar photovoltaic and wind energy production

During the week of March 10, solar photovoltaic energy production decreased in several of the main European electricity markets compared to the previous week, although in the Iberian Peninsula it increased. In the Spanish and Portuguese markets, photovoltaic energy production rose by 45% and 33%, respectively, reversing the previous week’s declines. In the rest of the analyzed markets, solar energy production reversed the upward trend of the previous week and fell by 47% in Germany, 26% in Italy and 25% in France.

In the second week of March, the Portuguese market set an all?time record for solar photovoltaic energy production for a day in March. This happened on Friday, March 14, generating 21 GWh, a value last registered at the end of August 2024.

In the week of March 17, according to AleaSoft Energy Forecasting’s solar energy forecasts, solar energy production will increase in Germany, reversing the downward trend of the previous week, and it will decrease in the Italian and Spanish markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

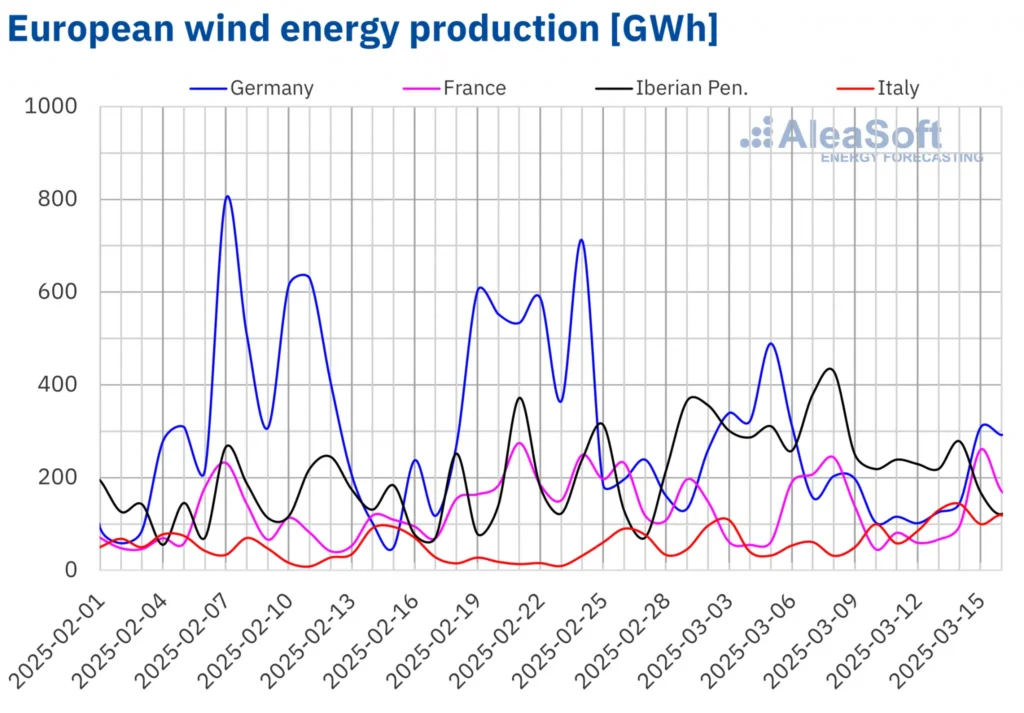

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

During the week of March 10, wind energy production decreased week?on?week in most major European markets, reversing the upward trend of the previous week. The Portuguese and German markets registered the largest declines, 42% and 41%, respectively. The French market registered the smallest drop, 19%. On the other hand, in the Italian market, wind energy production increased by 95%, reversing the downward trend of the previous week.

In the week of March 17, according to AleaSoft Energy Forecasting’s wind energy forecasts, wind energy production will increase in Germany, France, Spain and Portugal, but it will decrease in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

In the week of March 10, electricity demand showed an upward trend in the main European electricity markets, reversing the downward trend of the previous week. The Dutch, British and French markets registered the largest increases, 9.3%, 8.5% and 6.8%, respectively. In the remaining markets, increases ranged from 0.3% in Spain to 2.2% in Portugal. In Spain, this was the third consecutive week of increased demand. The Italian market was the exception, with demand falling for the third consecutive week, this time by 2.0%.

The increases in demand are linked to decreases in average temperatures. These declines ranged from 1.3 °C in Portugal to 4.5 °C in Belgium. Again, Italy was the exception, with an increase in average temperatures of 3.0 °C.

For the week of March 17, according to AleaSoft Energy Forecasting’s demand forecasts, demand will increase in the British market and it will remain stable in the Spanish market. On the other hand, it will decrease in the German, French, Belgian, Italian, Portuguese and Dutch markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the second week of March, average prices of the main European electricity markets increased compared to the previous week. The exception was the IPEX market of Italy, which registered a drop of 4.7%. On the other hand, the N2EX market of the United Kingdom registered the smallest increase, 6.1%, while the Nord Pool market of the Nordic countries reached the highest percentage price rise, 264%. In the other markets analyzed at AleaSoft Energy Forecasting, prices rose between 18% in the EPEX SPOT market of Germany and 33% in the EPEX SPOT market of France.

In the week of March 10, weekly averages were above €100/MWh in most major European electricity markets. The exceptions were the Nordic market and the MIBEL market of Portugal and Spain, whose averages were €63.40/MWh, €79.57/MWh and €80.27/MWh, respectively. The Italian market reached the highest weekly average, €117.38/MWh. In the rest of the analyzed markets, prices ranged from €100.69/MWh in the French market to €113.82/MWh in the British market.

As for daily prices, despite the increase in the weekly averages, prices fell in the last days of the week. On Sunday, March 16, the Nordic market reached a price of €15.59/MWh, which was the lowest price of the week in the analyzed markets. On that day, the Italian market price was €86.08/MWh, its lowest price since September 30, 2024. In the case of the Dutch market, on March 16, it registered a price of €69.87/MWh, which was the lowest price in this market since January 28, 2025.

In the week of March 10, the increase in electricity demand and the drop in wind energy production led to higher European electricity market prices. Moreover, solar energy production declined in some markets. In addition, CO2 prices increased and gas prices recovered, exceeding €40/MWh again, after falling below that level in the last sessions of the previous week. However, demand fell and wind energy production increased in Italy, contributing to the price decline in this market.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the third week of March, prices will fall in most European electricity markets, influenced by increased wind energy production. In addition, electricity demand will fall in some markets and solar energy production will increase in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

On Monday, March 10, Brent oil futures for the Front?Month in the ICE market registered their weekly minimum settlement price, $69.28/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since September 11, 2024. Subsequently, prices increased until March 12. On that day, these futures reached their weekly maximum settlement price, $70.95/bbl. After falling 1.5% on Thursday, prices recovered on Friday, March 14. On that day, the settlement price was $70.58/bbl, 0.3% higher than the previous Friday.

In the second week of March, concerns about the effects of US policies on global economy and oil demand continued. However, difficulties in reaching a ceasefire in Ukraine led to a price recovery at the end of the week.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, March 10, they registered their weekly minimum settlement price, €41.23/MWh. However, this price was already 3.2% higher than in the last session of the previous week. On Tuesday, increases continued. On that day, these futures reached their weekly maximum settlement price, €42.71/MWh. Subsequently, prices remained above €42/MWh. On Friday, March 14, the settlement price was €42.29/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 5.8% higher than the previous Friday.

Declining temperatures and low European reserve levels kept TFF gas futures prices above €42/MWh for most of the second week of March.

Regarding settlement prices of CO2 emission allowance futures in the EEX market for the reference contract of December 2025, they rose in most sessions of the second week of March, except on Tuesday. On that day, these futures registered their weekly minimum settlement price, €68.24/t. In contrast, on Friday, March 14, they reached their weekly maximum settlement price, €70.99/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 3.4% higher than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and renewable energy financing and energy storage

On Thursday, March 13, AleaSoft Energy Forecasting held the 53rd webinar in its monthly webinar series. This webinar featured speakers from EY for the fifth consecutive year. In addition to the evolution and prospects of European energy markets, the webinar analyzed the key milestones for 2025 in the energy sector, the regulation and prospects for energy storage and capacity markets, the financing of renewable energy projects, the importance of PPA and self?consumption, as well as key aspects for portfolio valuation. If AleaSoft Energy Forecasting is your market advisor, you can request the recording of the webinar.